If Pasadena’s latest sales tax revenue report numbers were tea leaves for reading the City’s financial future, another cup might require brewing to clarify the picture.

Sales tax revenues now hold added importance to the City and the School District as both will receive revenues from a higher city sales tax going into effect in April.

Whether tax income is going up or down will have a meaningful impact on both agency’s ability to serve the public.

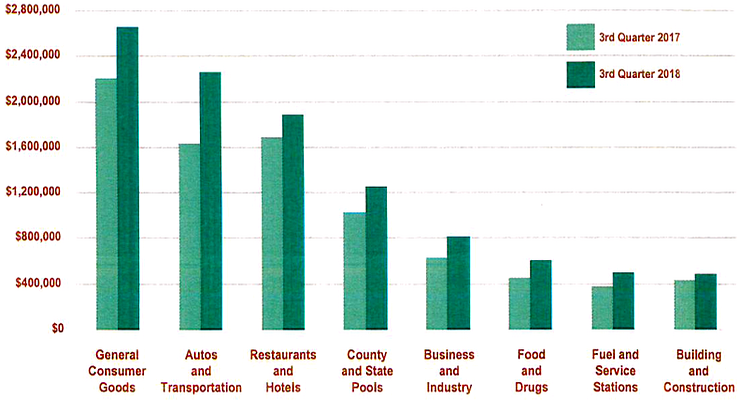

Released Jan. 24 as part of the City Manager’s newsletter, the 2018 third quarter results showed that total sales tax revenues were $10,484,934, up 24 percent from the same period in 2017.

Released Jan. 24 as part of the City Manager’s newsletter, the 2018 third quarter results showed that total sales tax revenues were $10,484,934, up 24 percent from the same period in 2017.

But the figure is deceptive because it comes with a pair of caveats. The first caveat is that $2.1 million of the total receipts represented were catch-up payments owed by the State of California from earlier quarters.

Once that figure is factored in, the sales revenue increase drops to a more modest 9.2 percent.

The second caveat, according to the report is that, “The boost in revenue from auto sales was largely due to a single manufacturer filling back orders.”

Matt Hawkesworth, the City’s Director of Finance, said that what percentage of the 9.2 percent could be attributed to the automobile backorders was confidential information.

As to what the figures may foretell for the future of municipal sales revenues, Hawkesworth commented, “It certainly shows that receipts are trending up a bit.”

Asked if the latest numbers impacted the City’s projection of $21 million-worth of sales tax revenue in the first year from Measure I, Hawkesworth responded: “We have not amended our forecast for Measure I.”

Paul Little, President and CEO of the Pasadena Chamber of Commerce, suggested the caveats skew the numbers: “It is really hard to say whether things are stronger or weaker because of that.”

Much the same goes for determining what Measure I revenues will be.

“It is really difficult to tell,” said Little. “The better indicator will be the fourth quarter, because that includes the holidays. What I’m reading is that the larger retailers, at least, did not have the holiday season they had hoped for.”

As for the coming sales tax, which takes effect April 1, Little said he has not heard much from the chamber’s members of late.

“It is what it is,” he explained. “I think there is more of a sincere desire to see how the money is spent once it’s collected. They’re concerned about accountability.”

Little concluded that the sales tax alone is not the biggest concern for local businesses, rather the cumulative impacts of the sales tax, the minimum wage, rising rents and product costs.

“When you compound all of that together, it makes it more difficult to maintain and run a business,” said Little.

Last November, Pasadena voters overwhelmingly passed Measure I and its companion Measure J, which will give one-third of the new ¾ cent city tax to the Pasadena Unified School District.

Proponents for Measure I had warned that failure to pass the Measure would lead to cuts in essential city services.