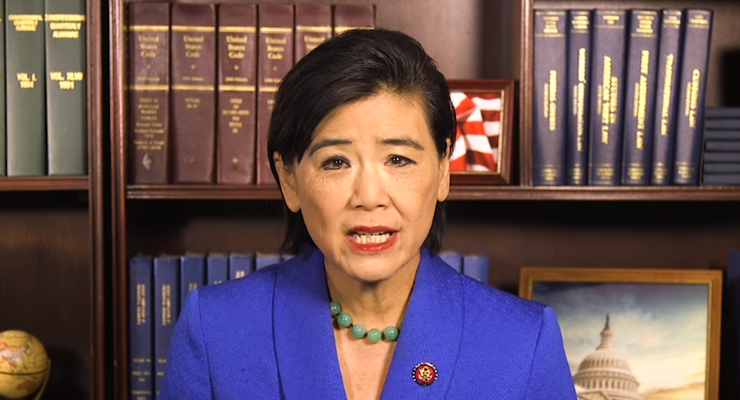

Rep. Judy Chu (D-Pasadena), chair of the House Subcommittee on Investigations, Oversight and Regulations, penned a letter to Small Business Administration (SBA) Administrator Jovita Carranza seeking more information on the status of the SBA’s Economic Injury Disaster Loan (EIDL) program.

EIDL has served as a critical lifeline to small businesses amidst the ongoing pandemic, supporting $366 billion in new lending. In recent months, government watchdogs have highlighted the potential for fraud and abuse in the program.

Thousands of Pasadena businesses received loans through the SBA when the pandemic forced all but essential businesses to close.

In June, the City Council voted 7-1 to approve the creation of the “COVID-19 Emergency Fund for Small Businesses.” Eligible businesses cannot have received $10,000 from the EIDL program.

“To date, Congress has appropriated $70 billion for EIDLs and $20 billion for EIDL advances, supporting $366 in new lending. Yet, the publicly available data does not provide the necessary detail to determine the effectiveness of EIDLs or the precise amount remaining in the fund,” Chu wrote.

“The opaqueness of the EIDL process and lack of detailed data is concerning, and we believe greater transparency between SBA, EIDL applicants and Congress is necessary to strengthen the program,” the letter stated.

In March, Congress opened the EIDL program to small businesses with COVID-19-related economic injury, making it the first economic relief program offered to small businesses impacted by the pandemic. Since then, Congress has appropriated billions of dollars for additional loans and grants for the program.

On Oct. 28, SBA’s Office of Inspector General (OIG) released a report detailing instances of fraud and potential fraud within EIDL. The report noted a lack of adequate internal controls in the EIDL review process that left the program vulnerable to abuse.

In the letter, the lawmaker calls on the agency to increase transparency to help Congress improve fraud prevention efforts within the EIDL program.

“While we understand SBA had to act quickly to get money into the hands of small business owners, having the proper internal controls in the program is vital to prevent waste, fraud, and abuse,” the letter states. “Moving forward, we want to ensure the EIDL program is operating with minimal fraud, SBA can quickly and easily identify improperly disbursed loans, and the agency has the ability to recover the taxpayer dollars identified as fraudulent. We are committed to working in conjunction with SBA and OIG to address concerns in as fair and effective a manner as possible.”

0 comments

0 comments