An agreement in Washington DC was on track to be reached as early as Sunday to provide billions of dollars more to small businesses in a package stalled in Congress.

“I think we’re very close to a deal today. I’m hopeful that we can get that done,” Mnuchin told CNN’s Jake Tapper on “State of the Union.” Mnuchin told Tapper he is hopeful that if a deal is reached, the Senate could pass the bill on Monday and the House could pass the bill Tuesday.

Congressional Democrats also said Sunday the parties were nearing an agreement.

The funding would be used to fund the Payroll Protection Program, a program for small businesses affected by the Coronavirus crisis that ran out of funding last week.

The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll.

SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities.

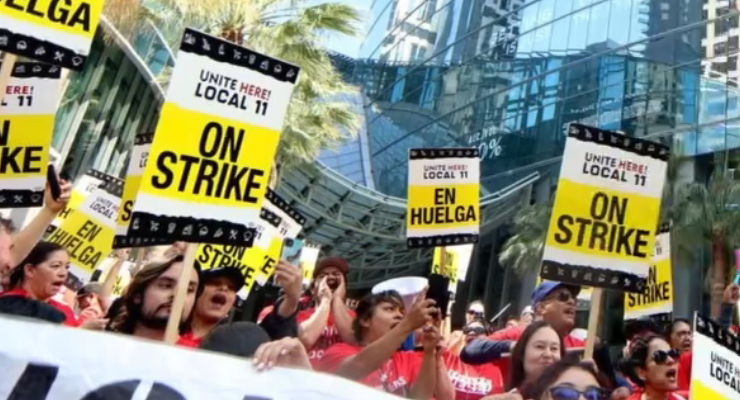

The funds could not come sooner as local rent activists begin calling for a rental forgiveness moratorium that would allow those businesses to continue to operate.

“If I have a small cafe and nobody can come into my cafe to buy coffee and biscuits then I’m going out of business,” said tenants activist Ryan Bell. “There has been some federal legislation, state legislation that even from LA, which obviously doesn’t apply in Pasadena, but there are efforts underway to support small businesses. And I think that’s important.”

The city’s moratorium passed on March 17. The moratorium prevents evictions for residential and commercial tenants who are unable to pay their rent, aso long as the city’s state of emergency remains in place. Any unpaid rent is required to be paid back within six months after the state of emergency is lifted.

Commercial realtor Bill Ukropina believes tenants should not get free relief unless owners are not also receiving the same benefit.

“I’ve been around 35 years,” Ukropina said. “I was born in [Huntington] Hospital. I love this market. I love Pasadena. I am involved in a lot of charities and I’m trying to be helpful to people, but, this is a new ground and I’m nervous. We do have to reopen the economy pretty soon. Can you imagine if this went on the rest of the year?”

According to the website Womply, which seeks to help small businesses thrive in a digital world by providing data, 55 percent of small and local business owners say their business wouldn’t survive if sales stop for one to three months. 21 percent said their business wouldn’t even survive one month.

Many of Pasadena’s restaurants are small businesses and have been required to close their dining areas due to order that currently only allow them to sell take our orders.

“What we don’t want to see is a big corporate landlord, bailed out by their bank and then that landlord turns around and evicts their tenants,” Bell said. “And what we were saying as activists in 2009 was that Wall Street got bailed out, but main street was left to suffer. We can’t have that again.”

0 comments

0 comments