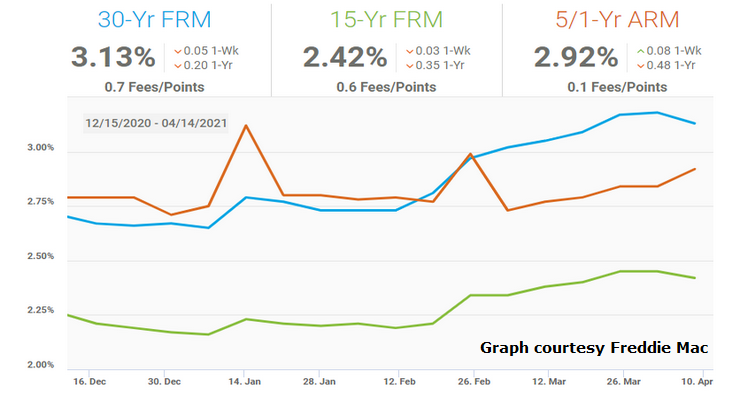

After what some local realtors called the lowest interest rates they had seen “in decades,” mortgage rates had begun to creep back up. Then they dropped last week.

The 30-year fixed-rate mortgage averaged 3.18% for the week ending April 1, up one basis point from the previous week, Freddie Mac reported last Thursday. It was the seventh consecutive week in which the benchmark mortgage rate has climbed, the highest level since June 2020.

Then on April 8, Freddie Mac reported “After moving up for seven consecutive weeks, mortgage rates have dropped due to the recent, modest decline of U.S. Treasury yields.”

“The drop in rates creates yet another opportunity for those who have not refinanced to take a look at the possibility.”

Any rise, even a small one, can be significant for buyers and the market as a whole.

For comparison, early this year, Realtor Adam-Bray-Ali described the situation thusly:

“On January 2nd, 2020, interest rates were 3.72, and on January 28th, 2021, they were 2.73,” he explained. “That’s a full 1% lower. Now what that does over that one year period, is that every mortgage broker in town is calling their clients and saying, ‘It makes sense to refinance.’”

According to Bray-Ali, for people who are looking to buy, a 1% decrease in interest rates is a very big move. It makes homes more affordable on a monthly basis, which pushes demand even higher.

“If you say ‘I’m going to be borrowing $500,000, how much is it going to cost me per month?’ Well, if it’s 2.7, 3% interest versus 3.7, 2% interest, it’s a big difference,” Bray-Ali continued.

That was in February.

A lot has happened since, as Kennedy Kenji Tatsuno, president of Kennedy Capital, a mortgage company, told Pasadena Now Wednesday.

While a number of leading sources including the Brookings Institute have predicted inflation won’t be a big factor this year, Tatsuno may not be convinced, owing to the flood of money pouring into the U.S. economy this year as well as the foreseeable end of the pandemic in the coming months.

“We’re going into more of a herd-type immunity system, as vaccinations and vaccines are much more readily available,” said Tatsuno. “Plus with the disclosure of the huge amount of the stimulus package being passed again, money is going to be spent more openly, especially now that everybody is going to be getting either their stimulus checks or subsidized unemployment checks, since they got the PPP coming back out.”

“So money is going to be much more readily available now fast,” he continued, saying, “It’s already come into play in the month of March.”

Tatsuno said that more money in the money supply and “the fed printing money” will affect mortgage-backed securities.

According to Tatsuno, a sell out of mortgage backed securities and treasury bonds has a direct correlation with the rise of interest rates, which he estimates have risen from 3/8ths to ½ percent in the last 30 days.

Asked what a regular fixed mortgage rate would be today, Tatsuno says a lot of factors come into play.

“Is it a purchase? Is it a refinance?” he asked. “A refinance in today’s market is going to be a little bit more expensive than if you purchase a property.”

Higher, even slightly higher interest rates can make it more difficult for first-time buyers to compete against repeat buyers with considerable equity from their prior home or all-cash institutional investors willing to waive all contingencies,” Realtor.com senior economist George Ratiu said recently.

“The increase in mortgage rates is adding yet another obstacle for these home buyers to overcome.”

But Tatsuno is essentially looking at a “fueled economy” this year, what he describes as a “sugar high.”

“It’s going to be short-lived because it’s really just an injection of monetary policy coming into the marketplace,” he explained. “And very similar to 2020, (when) the economy started slowing down again in October. And that’s when interest rates started getting prime again, probably October, November, all the way up until, you know, maybe January.

His projection? For the next six months, we will likely see a rise in interest rates rise, but sometime between the fourth quarter and the first quarter of 2022, the economy will begin to see another small reduction in interest rates.

The economy may also see some more fed intervention “after all of this money runs out,” he said.

Gazing around locally, Tatsuno acknowledged that, “There is still a high lack of jobs and it really just those people in the third party or in the hospitality industries, the entertainment, the restaurants, and travel.

He also pointed out the closures of Nick’s Restaurant, Paul Martin’s, and Roy’s restaurants, locally,

“I think for the short-term, short-term being the next six months,” said Tatsuno, “expect interest rates to rise. I will say maybe a quarter percent, so that’s not untypical.”

But others believe in a much more positive future with rates essentially staying low and feeding the market.

“I’m still in the camp that rates are going to continue low,” said Realtor Ann-Marie Villicana. “They may go up and down — that’s what they do. It’s going to be small. I don’t see any drastic moves.”

Paul McPherson

Then, there’s a lot of agitation brought up by talks about a $15 minimal wage, and by people refusing to work for low wage or to pay rent. That kind of instability isn’t easy to handle for lenders! Still, the only things that are clear are that smaller cities are going to profit from the post-pandemic real estate market changes, that’s something that tranio.com’s articles were already mentioning back in 2020.