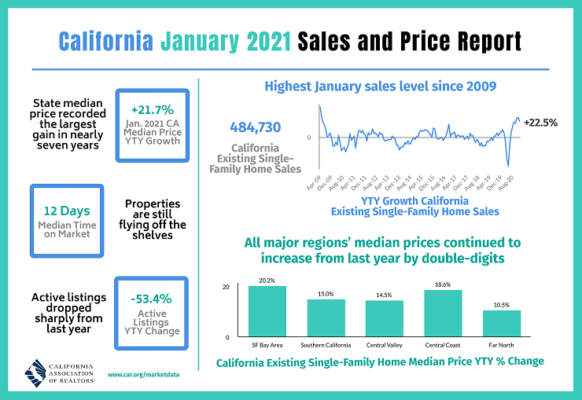

Image Courtesy California Association of Realtors

Southern California saw significant increases in both home sales and median sale prices in February compared with the prior year, according to data from the California Association of Realtors.

Home sales in Southern California grew by 10.5%, compared with a statewide average of 15.9%, according to a report released by the CAR.

The median home price in Southern California reached $675,000, representing a yearly increase of 10.5%, the data shows. The trend was even more pronounced in Los Angeles County, where an average median price in February of $664,120 represented a 13.9% increase over 2020.

At the state level, CAR reported home sales were up by 15.9%, and the median home price had declined by 0.1% to $699,000.

“The available supply of homes for sale continued to tighten up across the state, with all major regions at record low levels not seen in the past 10 years,” the statement said.

The Southern California region saw a 55.4% decline in inventory, according to CAR.

Eric Sussman, an adjunct professor of accounting and real estate at UCLA’s Anderson School of Management, said the region is far from alone.

“It’s not just Southern California,” he said. “It’s a global phenomenon that housing prices are higher, literally and figuratively, around the world. And so what you’re seeing in Pasadena and what we’re seeing in Southern California is hardly unique. It’s its own sort of virus that spreads everywhere, but it’s really like anything else. It always comes down to those magical things in economics: Demand and supply.”

On the supply side of the equation, “…we haven’t built enough housing, whether it’s apartments or the detached single-family homes, for years and years. And that comes down to everything from lack of buildable lots, challenges with local zoning ordinances and getting approval to high building costs across the board,” Sussman said.

Increases in commodity prices haven’t helped foster new construction, either, he added.

“Oil prices are higher, which increases the cost for plastics and that PVC pipe. Lumber prices are way higher, steel, et cetera. So you’ve just got a flat supply.”

Baby boomers are also showing a tendency to remain in homes for longer than previous generations, Sussman said. Aversion to significant capital gains taxes may be one motivating factor.

CAR Deputy Chief Economist Oscar Wei said interest rates are also a key factor to watch.

“Low interest rates definitely draw people into the housing market,” he said. “I’m talking about record-low interest rates. The 30-year fixed rates, for example, set some new records a couple of months ago.

“But in the last few weeks we have been seeing that actually started climbing a little bit.,” Wei said.

Wei predicted inventory would improve in the coming months.

“I do believe that we are going to see more supply in the home-buying season… in April, May. We’re going to see more supply.”

Ziggy Zicarelli, owner and responsible broker at Style Realty and Investments in Los Angeles and a former President of the CAR said as the pandemic lifts, new opportunities will be ushered in.

“It’s an opportunity, as I see it. People are looking to get a piece of the American dream. All indications point toward a robust stellar market in the second and third quarters, and people want an opportunity to jump in,” he said.

The past year has changed many people’s attitudes toward their living arrangements, Zicarelli said.

“People are now working out of their homes and fortunately, or unfortunately, people are realizing that this is possibly the future. This is where things are going,” he said. “And now, looking at homeownership, they’ve come to the conclusion that possibly this might be the way to go.

“So it’s important for people to realize that there are opportunities and I believe more people are taking advantage of that,” according to Zicarelli.

He said he recognized some would-be homeowners are running into frustration due to the limited supply, but persistence may pay off.

“Prices are not going down. I can assure you that,” Zicarelli said. “They may level off, but they will continue to go up.”