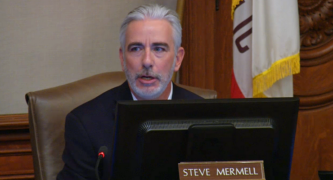

[UPDATED] In a letter to the California Public Employees’ Retirement System (CalPERS), City Manager Steve Mermell called for more transparency in new investment plans.

Last month, Mermell expressed concerns to the City Council and its Finance Committee regarding CalPERS’ new investment structure, which calls for putting 20 percent of the CalPERS portfolio into risky private investments.

“CalPERS has an obligation to its members and agencies to not only provide a sustainable pension system, but to do so as a public agency that is transparent and accessible,” Mermell wrote in a letter mailed Monday.

“Pursuing an investment strategy that increases investments in private assets and equity is concerning due to both the added risk and the inability to publicly value the investment,” Mermell wrote.

According to the letter, which was also sent to the City Council, Assemblyman Chris Holden and state Sen. Anthonty Portantino, Mermell met with CalPERS officials on July 28.

CalPERS manages pension funds in California, including nearly $1.3 billion for the city.

“Although public investment funds have used leverage for decades with great rewards and failures, local government agencies can no longer absorb failures from large pension system losses as the current unfunded accrued liabilities from prior losses are already crippling many agencies,” Mermell wrote.

“The pursuit of More Assets by issuing debt, as much as twenty-percent of the total plan’s portfolio, which does not include existing internal leverage included in certain investments or the billions of dollars of leverage from pension obligation bonds by local agencies, is also of great concern,” Mermell wrote.

“The City recognizes the need for leverage in the investment plan, the fact that it can provide positive results, and the fact that certain investments such as real estate or mortgage investments are leveraged. However, the pursuit of More Assets of up to $80 billion based on CalPERS’ current plan assets of almost $400 billion is risky and overly aggressive.”

For nearly 35 years CalPERS has followed three guiding principles in investing — safety, liquidity and yield — and sought a modest investment return or discount rate of 4 percent.

The rate eventually went to 7 percent, and despite new benefits designed to outweigh additional costs, member agencies, including Pasadena, continued to have concerns about rising pension costs, mitigating those and other costs, and balancing budgets.

In June, the CalPERS Investment Committee met in closed session to discuss a new investment strategy involving increased investments in private assets and emerged with a new strategy of better assets and more assets.

Two months later, the CalPERS’ Board of Directors voted to restructure the governance model and reduced the number of annual board meetings from nine to six.

In that meeting, the board also restructured its investment committee, changing it to a subcommittee with no decision-making powers, and decreased its annual meetings from nine to four.

Mermell called for regular and ongoing meetings with local agency members, including discussion methods beyond public comment at board meetings; conduct critical conversations regarding risk and investment plans in open session; and reconsider decisions to reduce the number of open session public meetings of the board and committees.

He also requested that CalPERS actively engage member agencies throughout its Asset Liability Management study process to have “earnest dialog” regarding decisions to take on increased risks to obtain a potentially unrealistic discount rate.

“The combination of disguising risk as Better and More Assets, conducting all discussions about it in closed session, and reducing public meetings is concerning for the city as a member that must be responsive to its community.”

“The City of Pasadena respectfully requests that CalPERS begin to have regular and ongoing meetings.”

Mermell cited a past bribery scandal as a need for transparency.

Fred Buenrostro, CalPERS chief executive officer, was sentenced to 54 months in prison in 2015 after he pleaded guilty to accepting cash and other bribes from Alfred Villalobos, who owned Arvco Capital Research.

Villalobos was charged with criminal bribery, but committed suicide weeks before his trial was scheduled to begin.

In a settlement, Arvco Capital Research later agreed to pay the state $20 million, including $10 million in attorney fees.

0 comments

0 comments